FAQ

We want to make your experience on our paltform as smooth as possible, here are some frequently asked questions,

if these dont solve your doubts, feel free to contact us.

Other names for algorithmic trading include automated trading, black box trading, and algo trading. The amount of human involvement in this sort of trading is minimal, and computer programs are employed to trade more quickly and in larger volumes in accordance with pre-established specifications.

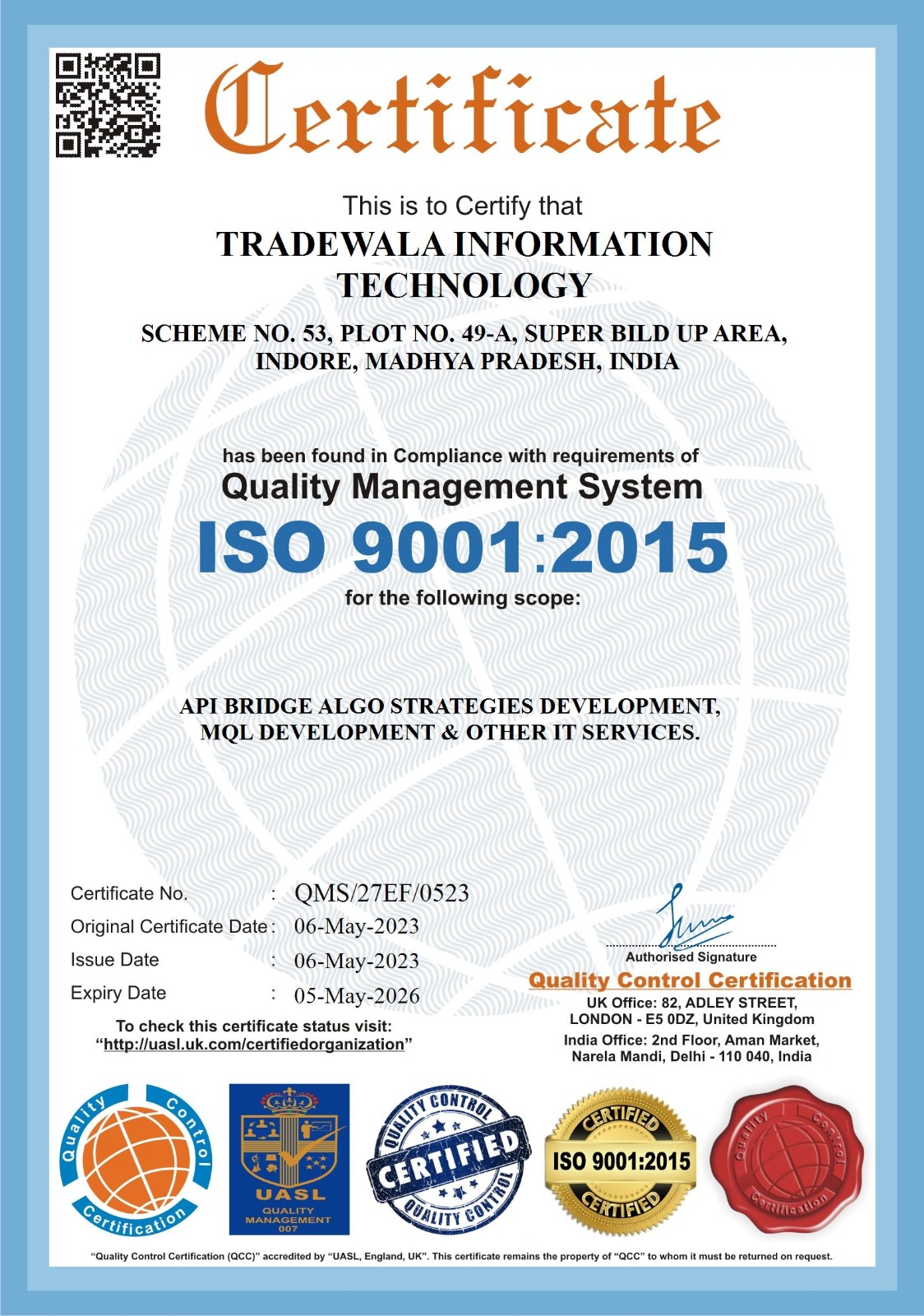

One of the greatest platforms for Algo Trading is offered by Trade Wala.

Arbitrage Opportunities, Index Fund Rebalancing, Time Weighted Average Price (TWAP), Volume-weighted Average Price (VWAP), Percentage of Volume (POV), and other algorithms are the most frequently utilized ones for trading.

Algo trading is automated trading with little to no human intervention. Algo Trading makes use of computer programs with pre-set parameters to trade at a rate that is too fast for a typical person.

Algo Trading's adoption is anticipated to increase quickly on a worldwide scale. Globally, it is anticipated that a major increase in algo trading would be seen in both the derivatives and commodity markets.

The profitability of stock trading algorithms is very high. Their returns easily outperform those obtained by a typical human trader using manual trading.

For trading in the financial markets, sophisticated mathematical computer programs can be used to construct an automated trading system.

Algo trading has some drawbacks, such as its reliance on technology, resource requirements, loss of human oversight, and potential for over-optimization.

There are many advantages of Algo Trading. Some of them are no human emotions, accuracy, speed, ability to backtest, discipline, consistency, etc.

Writing and evaluating Algo Trading structures can be done using Python's functional programming methodology.

Technically speaking, trading robots actually function and are a tool utilized by market traders.